Data Feed for Amibroker Fundamentals Explained

Data Feed for Amibroker Fundamentals Explained

Blog Article

The current Model is with thirty times validity from Registration…. your opinions and feed backs will probably be useful to Enhance the utility.

AmiBroker is a really impressive Software and to have the most from it, 1 needs a very good data feed. It is just a actual-time and historical sector data provider that delivers market data on your AmiBroker setting, which powers your technical Investigation and technique generation. Nonetheless, for newcomers, It is far from surprisingly easy to work Together with the Amibroker data feed

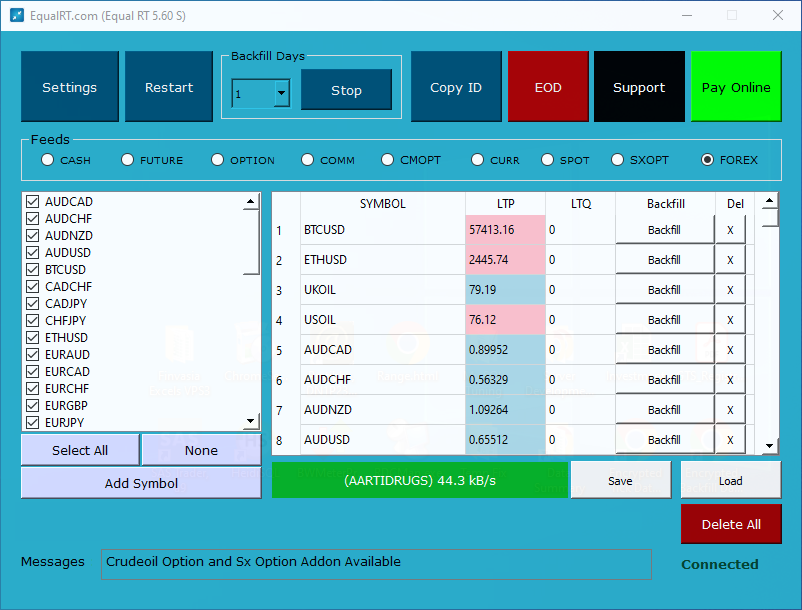

SHUT (purple light-weight) means that some serious problem transpired plus the plugin will never try to reconnect automatically.

TrueData is another common datafeed service provider for Amibroker as well as a number of other charting programs. It’s a certified data vendor from NSE and MCX. Truedata supplies data together with softwares methods for economical decision-making in economic market place transactions.

+ additional "Bare minimum" backfill duration that backfills in less than per day When you've got already some data from right now

+ additional protection from stopping backfill when person scrolls by means of symbol listing and invalid ticker is encountered

Historic data is Similarly significant for backtesting buying and selling procedures to be certain they are strong right before implementing them with authentic income. The dependability, pace, and accuracy of the data can directly effects the profitability and performance of buying more info and selling techniques, producing the choice of data seller a important part of profitable trading.

The right Amibroker data feed varies Along with the buying and selling technique, experience, and cash that you've got. Here are a few things to look at:

Remember to Take note that TWS API presently lets only one backfill at a time so when You will find a backfill already working from the background, automatic backfill request for upcoming image will be dismissed, right up until past backfill is entire.

AFL is made to quickly identify bullish or bearish tendencies in many shares by getting a acknowledged candlestick sample from 35 patterns with one click.

Not surprisingly, you are able to complete this manually by introducing charts and picking your individual purchasing and marketing details, which may be advantageous, but normally takes much too lengthy. You should make this happen manually For each and every stock you'll be able to imagine.

Combining diverse investing alerts, charts, and indicators often can help traders minimize risk and construct more powerful buying and selling approaches.

It is actually effortless to obtain this selection turned on, having said that it could potentially cause supplemental load on the Connection to the internet as a consequence of data required to be downloaded for the duration of backfill approach.

The pricing is determined by the membership time period and exchanges that you are opting the data for. At time of producing this informative article, for those who subscribe to each of the exchanges (NSE, File&O, CDS, and MCX), it will cost you 9340 INR per 30 days. Just in case you just have to have NSE data, the worth will come down to 2775 INR per month